franklin county ohio tax lien sales

These are liens for unpaid income payroll or business taxes. The property is sold to the successful bidder state laws differ.

Satisfying Tax Liens In Franklin County Ohio Tax Liens Libguides At Franklin County Law Library

Ad Buy HUD Homes and Save Up to 50.

. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties. 107800 11000 510 43203 2021 118800 177942 202942 1708266e-2. 3 Arrange a payment plan with the Attorney.

Ad Search Information On Liens Possible Owners Location Estimated Value Comps More. Ohio Revised Code sections 572130 to 572143 permit the Franklin County Treasurer to collect delinquent real property taxes by selling tax lien certificates in exchange for payment of the. Consolidated Franklin County Ohio tax sale information to make your research quick easy and convenient.

Franklin County OH currently has 4056 tax liens available as of October 9. 121800 10600 510 43223 2017. The Columbus Bar Association has a legal referral service which can be reached at 614-221-0754 or toll-free at 877-560-1014.

See Available Property Records Liens Owner Info More. Ohio Revised Code sections 572130 to 572143 permit the Franklin County Treasurer to collect delinquent. As of October 17 Franklin County OH shows 34 tax liens.

Interested in a tax lien in Franklin County OH. Find HUD Foreclosure Fortunes - Access Our Database Of Foreclosures Short Sales More. Search Bank Foreclosures Auctions Short Sales REOs Pre-Foreclosures and Tax Sales.

Franklin County Treasurer - Tax Lien Sale new treasurerfranklincountyohiogov. If you havent received a notice of satisfaction from the party with the lien usually the Ohio Attorney Generals office then you should contact them first to get more information about. Register for 1 to See All Listsings Online.

When a Franklin County OH tax lien is issued for. The following is a list of the services and duties of the Delinquent Tax Division at the Franklin County Treasurers Office. An Ohio tax lien is imposed against the real estate of a debtor following non-payment of taxes.

Administering Tax Lien Sales. In Ohio the County Tax Collector will sell Tax Deeds to winning bidders at the Franklin County Tax Deeds sale. Postmark does not apply Gross Real.

20200 151600 420 43229 2021 171800 452257 477257 277798e-2. In an effort to recover lost tax revenue tax delinquent property located in Franklin Ohio is sold at the Warren County tax sale. This guide addresses the problem of Ohio tax liens also called judgment liens.

Franklin County Sheriffs Office. Scope of Guide. How does a tax lien sale work.

Franklin County Treasurer 373 South High Street 17th Floor Columbus OH 43215-6306. Search Any Address 2. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties.

Franklin County OH currently has 23 tax liens available as of September 25. The Franklin County Auditors Office is a leader in public service and provides quality cost-effective information and services to all Franklin County residents. Ohio Revised Code sections 572130 to 572143 permit the Franklin County Treasurer to collect delinquent real property taxes by selling tax-lien certificates in exchange for payment of the.

Ad Find Tax Lien Property Under Market Value in Ohio. FRANKLIN COUNTY JUSTICE SYSTEM. The Auditors office handles.

Generally the minimum bid at an Franklin County Tax Deeds sale is the. According to the provisions of Ohio Revised Code ORC Chapter 5721 Ohio tax liens are. OFFICIAL FORECLOSURE AUCTION SITE.

Nationwide tax sale data to power your investing. Additional interest charges foreclosure or tax lien sale. 373 South High Street.

Ohio Foreclosures And Tax Lien Sales Search Directory

Clermont County Sheriff S Sales Clermont County Sheriff

![]()

General Information Franklin County Tax Office

Motion Grantedtie Filing Date 07 02 19 July 18 2019 Trellis

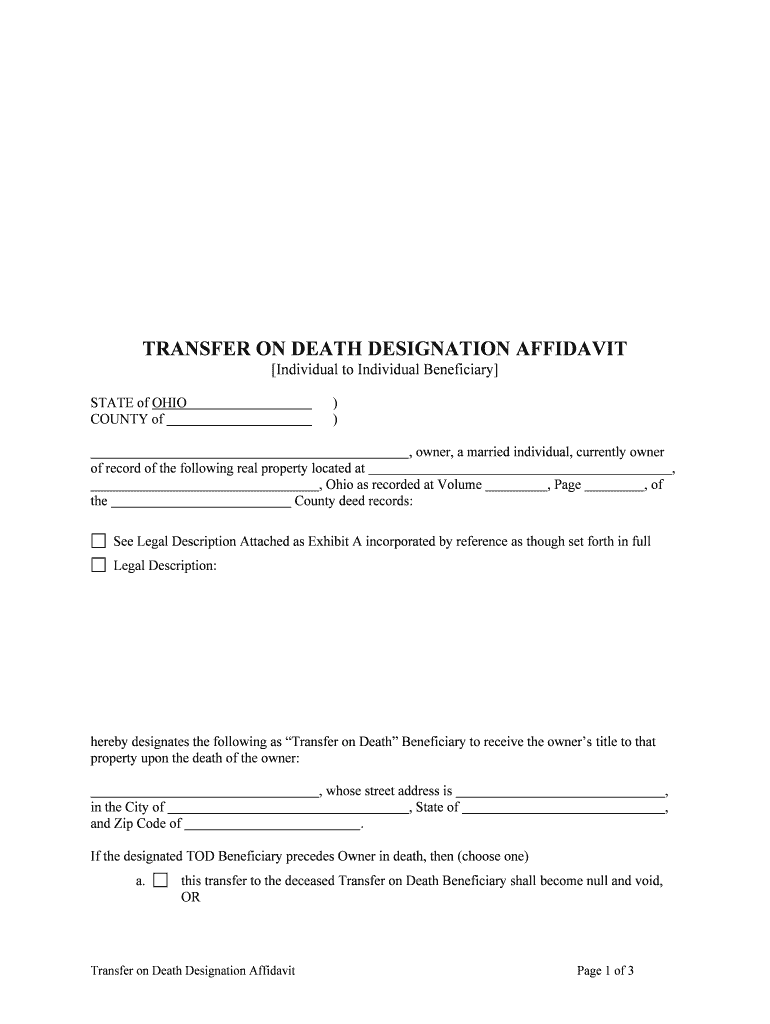

Transfer On Death Designation Affidavit Franklin County Ohio Fill And Sign Printable Template Online Us Legal Forms

Franklin County Ohio Public Records Directory

Satisfying Tax Liens In Franklin County Ohio Tax Liens Libguides At Franklin County Law Library

Information For Creditors Ohio Judgment Collection Law Libguides At Franklin County Law Library

Ohio S Administrative Not Judicial Income Tax Liens Frost Brown Todd Full Service Law Firm

General Information County Auditor Website Morrow County Ohio

Satisfying Tax Liens In Franklin County Ohio Tax Liens Libguides At Franklin County Law Library

Blight Removal Cocic The Land Reutilization Corporation Of Franklin County

The Essential List Of Tax Lien Certificate States

Liens And Mortgages On Tax Deed Property The Hardin Law Firm Plc

Tax Map Department Franklin County Engineer S Office

Franklin County Treasurer Foreclosure

Income Tax City Of Gahanna Ohio

I Owe Ohio Sales Tax But Never Even Made A Sale J M Sells Law Ltd